Noted: More Dilution Awaits

Founders and existing shareholders in startups have used an assumption for the last decade that is suddenly no longer true, and it means unexpected dilution for everyone.

Giving Everyone a Piece of the Pie: Why We Invested in pieFi

pieFi Raises $4.6 Million, Launches Upside.coop, and Co-Publishes White Paper on Regulatory Clarity in Web3

Bringing Benefits to the Center: Our Investment in Fringe

Fringe’s benefits marketplace gives employers the ability to address their employee’s needs by empowering the employees themselves to invest in the products, subscriptions, and services that are right for them.

Coaching for ‘Reformers’ to ‘Peacemakers’, ‘Analysts’ to ‘Explorers’: Why We Invested in Cloverleaf

Cloverleaf is a powerful coaching tool that unleashes people to do their best work, together.

Why I Joined Origin Ventures: Linda Watchmaker

Linda Watchmaker, Origin Ventures’ new CFO, shares her story.

Origin Ventures Promotes Jacquie Marshall Siegmund to Principal

Announcing the next step in Jacquie’s Origin Ventures story.

Chopping Up Compute: Why We Invested in Salad Technologies, Inc.

Salad is the largest compute-sharing network that allows gamers to exchange idle resources for rewards.

Airing the Dirty Laundry on the Front Porch: Why We Invested in SudShare

Sudshare is the leading nationwide marketplace for peer-to-peer laundry service.

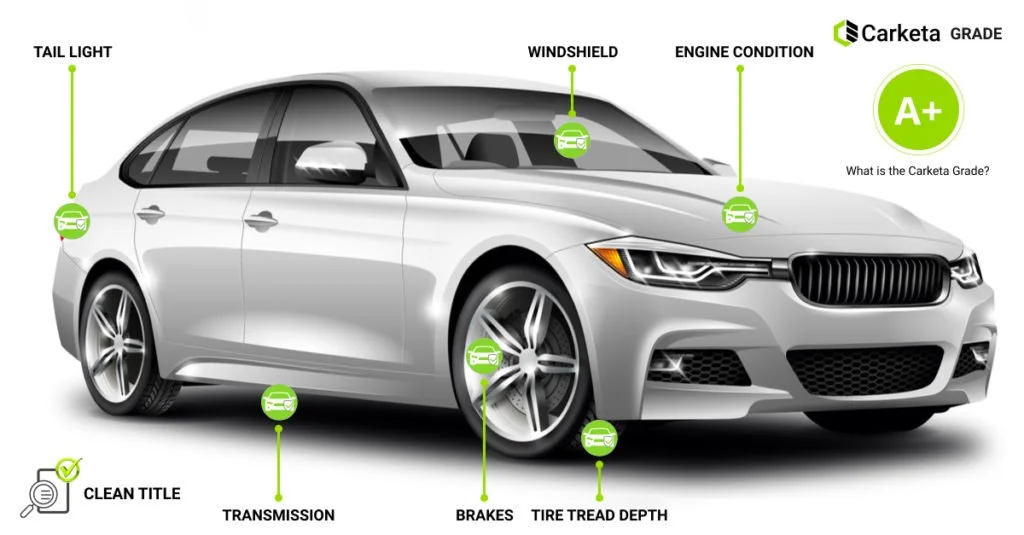

No Brakes Needed: Accelerating the Digital Transformation of Auto Dealerships

It all begins with an idea.

Origin Ventures Closes Oversubscribed Fifth Fund at $130M

Origin Ventures closes and oversubscribed 5th fund at $130M.

Invoice Less, Create More: Our Investment in Lumanu

Lumanu makes payments less painful for Creators.