Sneakerheads Find their Home: Our Investment in SoleSavy

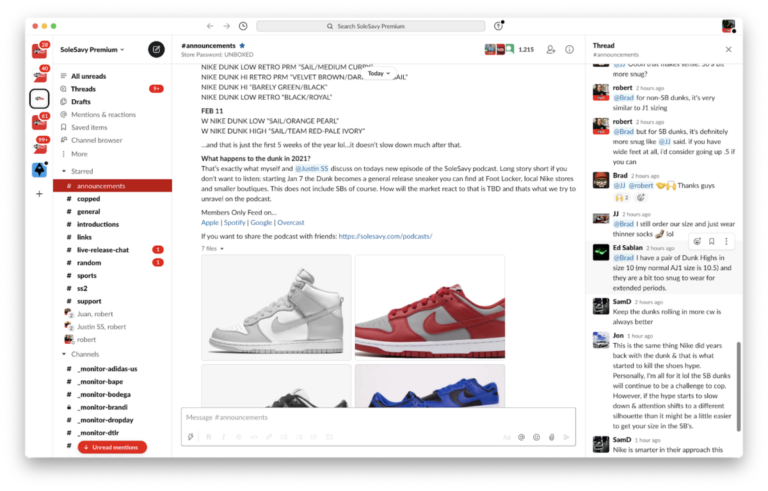

On January 19th, 2021, I added myself to the waitlist for a paid sneaker enthusiast community called “SoleSavy”. A quick Twitter search revealed hundreds of posts from members raving about what the platform enabled them to do: acquire hard-to-find sneakers at reasonable retail prices. Once I was accepted off the waitlist by the CEO and co-founder – Dejan Pralica, who has personally processed more than 5,000 members – I discovered a vibrant and fast-growing community built on top of Slack.

Beyond the software, tools, and tips that help members acquire products they want, the magic of the community lives in channels like #wdywt (where folks post photos answering the question “what did you wear today?”), #tradesonly (where members swap shoes), and #assists (where members ask for help obtaining particular items). The core value propositions, including direct purchase links and time-sensitive alerts, have helped me acquire (a few too) many pairs of new sneakers in the past few months. Members are batched into cohorts based on when they join the platform, which helps keep each Slack group at a manageable size and fosters a sense of community as people befriend each other and maintain close connections.

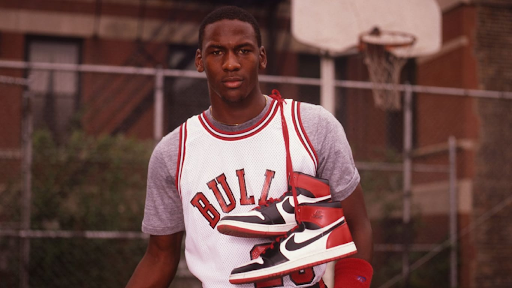

The cultural movement around sneakers was born in 1984, when Michael Jordan signed his first contract with Nike and the Air Jordan sneaker was released. Nike initially predicted sales of $3M for the first year of the Air Jordan line. It ended up with sales of $126M in that year, and a new consumer fashion category was unleashed. Today, the annual global sneaker market size is well over $70B, with the resale market estimated to reach $30B by 2030. Sneaker culture is woven into the fabric of modern culture, touching art, music, sports, and entertainment.

SoleSavy’s membership rolls have grown more than 200% since its December 2020 Seed round. The company will use this new capital to upgrade its technology platform and launch new online services like a peer-to-peer marketplace, along with investments in content, events, and international expansion. COVID has accelerated and proven that online communities are spreading, growing, and here to stay.

Origin Ventures is excited to add SoleSavy to our portfolio and invest in the company’s $12.5M Series A led by Bedrock Capital with participation from Bessemer Venture Partners, LAUNCH, Panache Ventures, and several other investors.